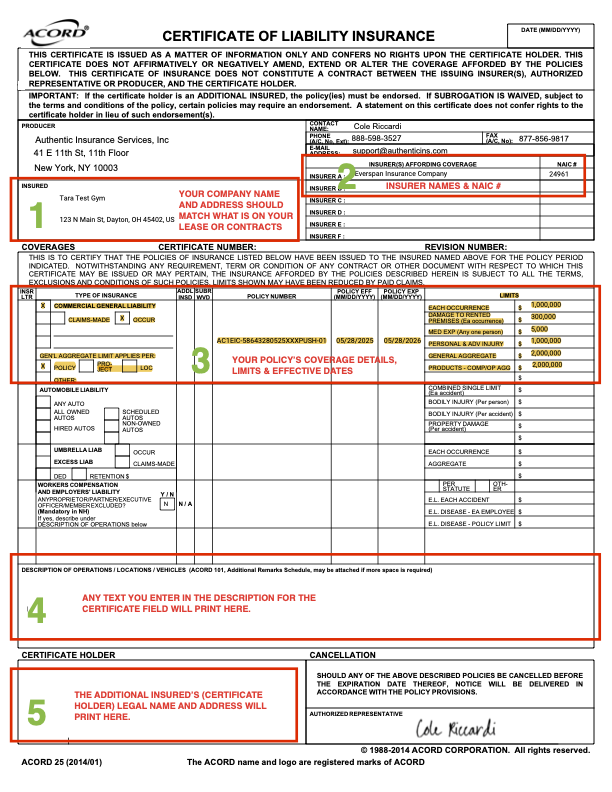

To add Additional Insureds to your policy,

You can add up to 50 Additional Insureds to your policy for no extra cost.

- What they're asking for: They want to be added to your General Liability policy for claims related to your business operations.

- Why? If a claim involves both of you, your insurance can help defend both parties.

- What this does NOT mean: They do not get their own policy. They are only covered for liability connected to your operations.

First up - you're not alone. This request often comes up with landlords, event partners, vendors, or lenders and banks. These requirements are very common and are mostly about making claims simpler if something goes wrong. Here's what they mean, in normal language.

- Waiver of Subrogation

- What they're asking for: If your insurance pays a claim, they don't want your insurer coming back to try to recover money from them.

- Why? It prevents follow-up lawsuits between insurers and protects business relationships.

- Good to know: This does not reduce your coverage or benefits in any way.

- Primary & Noncontributory

- What they're asking for: They want your insurance to respond first, without involving their insurance.

- Why? This avoids back-and-forth between insurers and keeps claims moving faster.

- Indemnification

- Where this shows up: This is usually in your contract with the landlord, partner, or other party.

- What is means: You agree to take responsibility for claims that arise out of your business activities.

- How insurance fits in: Your General Liability policy is designed to support this by covering defense and eligible claims.

How all of this fits together:

These requirements usually work as a package. This reduces confusion and speeds up claims handling.

- The contract assigns responsibility and your insurance backs that responsibility.

- Your policy pays first and the various insurers do not fight each other later.

Gym Insurance+ customers get unlimited access to customized COIs at no additional cost. To get your COI, log into your account